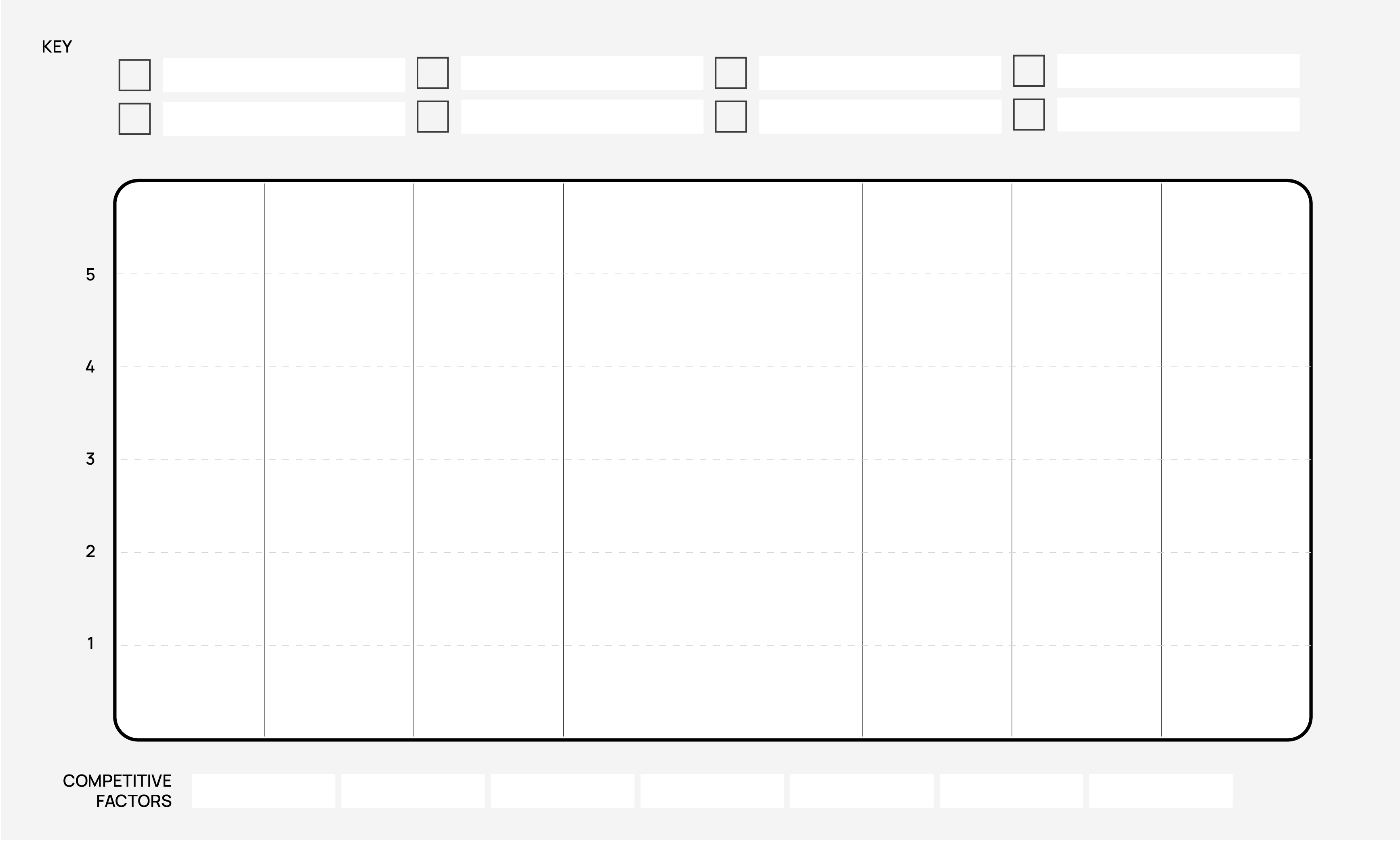

Blue Ocean Strategy Map

A Blue Ocean Strategy map helps organisations compare their offering against competitors across aspects that are important to customers. The Blue Ocean Strategy map helps to identify opportunities for differentiation and to create a “blue ocean”—a new, uncontested market space that makes the competition irrelevant.

Key concepts include:

Market: The entire space where organisations are competing. These can be categorised as red oceans or blue oceans.

- Blue Ocean: New, uncontested markets where competition is irrelevant because the organisation can create a unique value proposition.

- Red Ocean: Saturated market spaces where competition is fierce, and organisations primarily compete on existing competitive factors.

Competitive Factors: The criteria or features on which organisations in the market compete, such as price, quality, and service.

Value Curve: The line that plots an organisation’s performance across the competitive factors, visually representing how the organisation competes and where it might differentiate.

Four Actions: Actions organisations can consider taking to differentiate from competitors and offer new value. These are:

-

- Eliminate: Elimination of factors the market competes on that aren’t necessary.

- Reduce: Reduction of factors which don’t need to meet industry standards.

- Raise: Raising factors above the industry’s standard.

- Create: Introduction of new factors that the industry has never offered before.

The results

- Identification of areas in the market that have fewer competitors

- Understanding of competitor positioning

- Identification of opportunities to create unique value

When to use it

Product development: When designing a new product or service

Entering saturated markets: When seeking to enter existing markets that are overcrowded

Finding competitive advantage: When looking to innovate within an existing market

Strengths

Visually clear

Identifies differentiation opportunities

Facilitates innovation

Weaknesses

Doesn’t consider emerging trends or disruptors

Quality of analysis is dependent on data & insights

Subjective

More competitor focussed than customer focussed

How to use it?

What do I need to start?

Information relevant to the organisation or market. For example:

- Current market analysis

- Customer feedback

- Competitor insights

- Financial performance insights

- Industry trend insights

How to use it?

Who to involve?

The Blue Ocean Strategy Map is best done with a team. Consider involving:

- People who have deep understanding of customer needs and preferences

- People who have knowledge of the competitive landscape and industry trends

- People with diverse perspectives who might uncover innovative approaches

- People who are accountable for setting the strategic direction of the organisation

Step by step

1

Identify the target market

Define the specific segment or niche within the broader market that the organisation aims to serve.

It’s important to clearly identify the target market, so the competitive factors can reflect what matters most to these customers.

2

Identify key competitive factors

List the factors that customers consider important when choosing between competitors. Ask questions like:

- What do customers value most in our industry?

- Which factors influence customer decisions the most?

- Are there any emerging trends which might impact customer preferences?

3

Identify competitors

Consider who competes in the target market.

Identify both direct and indirect competitors. Direct competitors offer similar products or services, while indirect competitors might address the same customer needs in different ways.

4

Plot current industry offerings

Chart how current competitors perform on each competitive factor, on a relative scale such as 1 to 5.

Use a value curve to visualise the performance of each competitor.

Ask questions like:

- How do our competitors rank on each factor?

- Where do industry norms lie for each factor?

- Are there any factors where all competitors perform similarly?

5

Analyse competitor value curves

Compare the value curves to identify areas of similarity and differentiation.

Look for patterns and gaps that indicate opportunities or over-saturation.

Ask questions like:

- Where do competitors converge or diverge in their offerings?

- Are there any under-served or over-served factors?

- What patterns emerge from the value curves?

6

Determine the unique value proposition

Identify how the organisation can differentiate itself by focusing on unique or under-served factors.

Ask questions like:

- What unique value can we offer that competitors do not?

- Which under-served factors can we capitalise on?

- How can we leverage our strengths to create a unique position?

- How can we provide a new offering that serves customer needs and preferences?

Decide which factors to eliminate, reduce, raise, and create.

- Eliminate: Remove factors that no longer add value or are unnecessary.

- Reduce: Lower the level of factors that are over-served in the industry.

- Raise: Increase the level of factors that are under-served and add significant value.

- Create: Introduce new factors that have never been offered by the industry before.

Develop a compelling value proposition that stands out in the market.

7

Validate with customer feedback

Test the value proposition with customers to gather feedback and validate assumptions. Consider using customer surveys or focus groups.

Use the feedback to refine and adjust the value proposition before implementation.