BCG Matrix

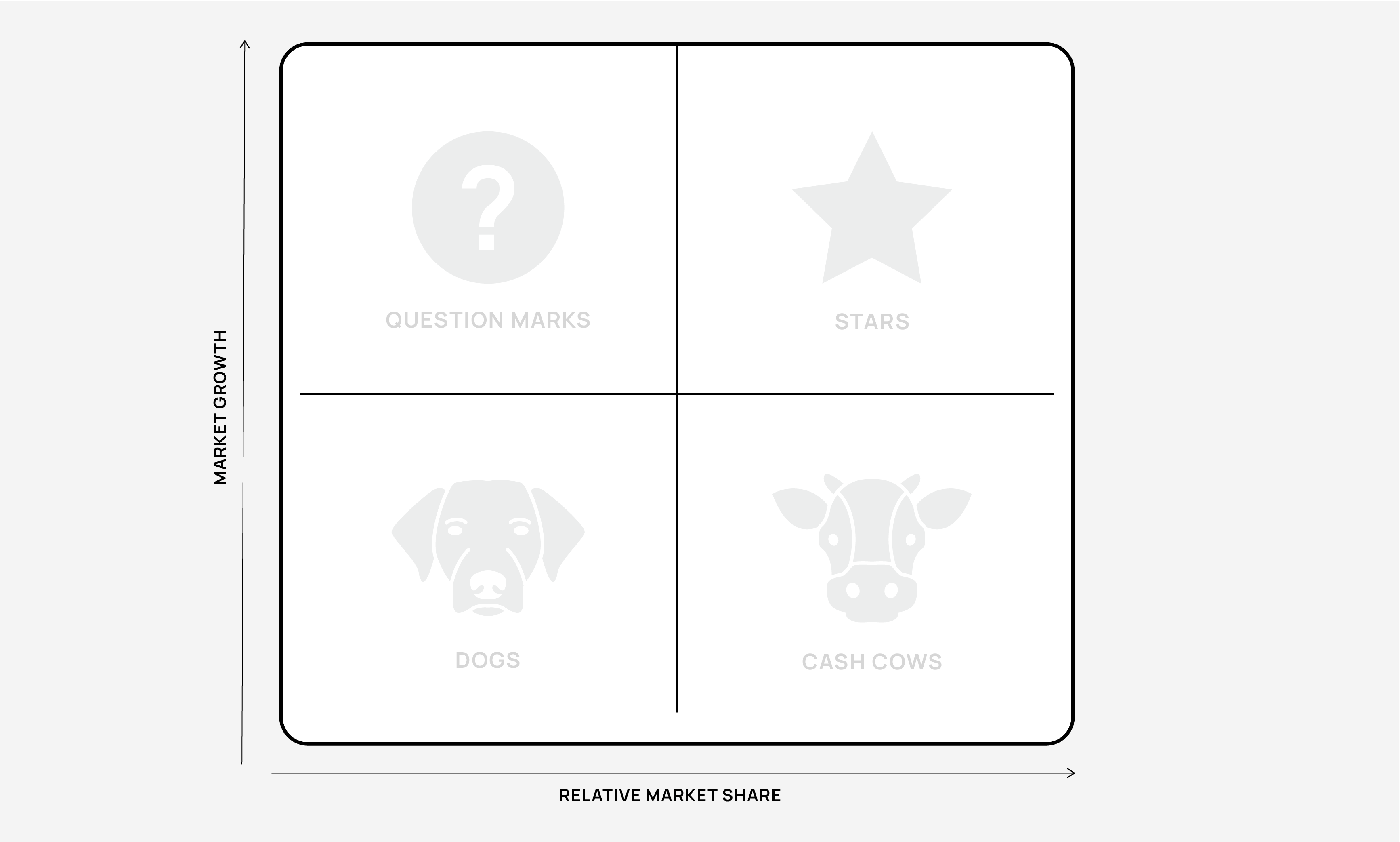

The BCG Matrix is a tool that helps businesses decide where to invest their money. It considers an organisation’s offerings and sorts them into four categories: Stars, Cash Cows, Question Marks, and Dogs. It helps with figuring out which areas are doing well, which need more investment, and which might not be worth continuing.

Key concepts important in using the BCG matrix:

Market share: Market share is how much of the market is captured by the organisations offerings compared to its competitors.

Market growth: Market growth is the rate at which the overall market size or sales are increasing.

Offering: An offering is the specific product, service, or category that is being analysed. For example, an organisation in the beverages industry might decide to populate BCG using specific products or categories of products like fizzy drinks, energy drinks, health drinks.

Each offering will sit in one of the four quadrants:

Stars: Offerings with high relative market share and high market growth. Stars may require investment to maintain their position.

Cash Cows: Offerings with high relative market share and low market growth. Cash cows tend to be mature products where organisations aim investments toward maintaining market share.

Question Marks: Offerings with low relative market share and high market growth. Organisations might aim to move some question marks into ‘stars’ by developing strategies to capture more of the market.

Dogs: Offerings with low relative market share and low market growth. Dogs tend to be a drain on resources. Organisations may aim to minimise losses by limiting further investments.

The results

- A clear assessment of each offering

- Options on where to invest, develop, or divest resources

When to use it

Strategy Formulation: When evaluating or making strategic decisions

Portfolio Analysis: When evaluating the relative performance of various offerings to identify which areas to invest in, develop, or divest.

Strengths

Visual

Simple and easy to apply

Good for organisations with a portfolio of offerings

Well known

Weaknesses

May overlook important relationships between offerings

Emphasises current performance and current market growth

Not practical for early stage organisations

Doesn’t consider market size

How to use it?

What do I need to start?

- Insights on the market growth and market share for each offering

- Insights on the current performance of offerings

How to use it?

Who to involve?

The BCG matrix is best done with a group who have insights across the offerings. This might include:

- People who are familiar with the strategic goals and long-term vision of the organisation

- People who have deep understanding of customer needs and preferences

- People who have knowledge of the competitive landscape and industry trends

- People who can provide insights on financial performance and market share

Step by step

1

Define the purpose

Clarify the purpose of the exercise.

Consider defining the scope of the exercise if there are a large number of offerings to analyse.

2

Define the criteria for scoring each aspect

Define the scoring for market growth and market share, clarifying what qualifies as high, medium, or low.

3

Gather necessary data

- Identify the organisation’s key offerings.

- Identify the markets the offerings compete in.

- Determine how fast the market/s are growing. Consider using market research reports or industry analysis.

- Identify key competition in the market.

- Evaluate how the organisation’s offerings are performing in terms of market share relative to leading competitors.

4

Plot offerings

Place each offering on the matrix based on its relative market growth and market share.

5

Analyse and gain insights

Stars: Evaluate if additional investment is needed to maintain or enhance market position. Ask questions like:

- How can we support and maintain the position of Stars?

- Is further investment justified?

Cash Cows: Consider how to sustain profitability and if the profits should fund other areas. Ask questions like:

- How can we continue to maximise profits from Cash Cows?

- Should funds be diverted from Cash Cows to support Stars or develop Question Marks?

Question Marks: Determine if these offerings can be developed into Stars or if resources should be reallocated. Ask questions like:

- Do we have a unique competitive advantage in this market?

- Could these offerings have the potential to become Stars with more investment?

- Should we focus investments elsewhere?

Dogs: Determine the potential of offerings and decide on next steps. Ask questions like:

- What is the size of the market and is it attractive?

- How easy would it be to capture market share and is that of interest?

- Are these offerings draining resources?

- Is it time to divest or reposition them?

6

Decide on next steps

Decide on next steps based on the analysis.